Articles

The Collapse Of The Watch Market – Why are prices falling?[October 2024]

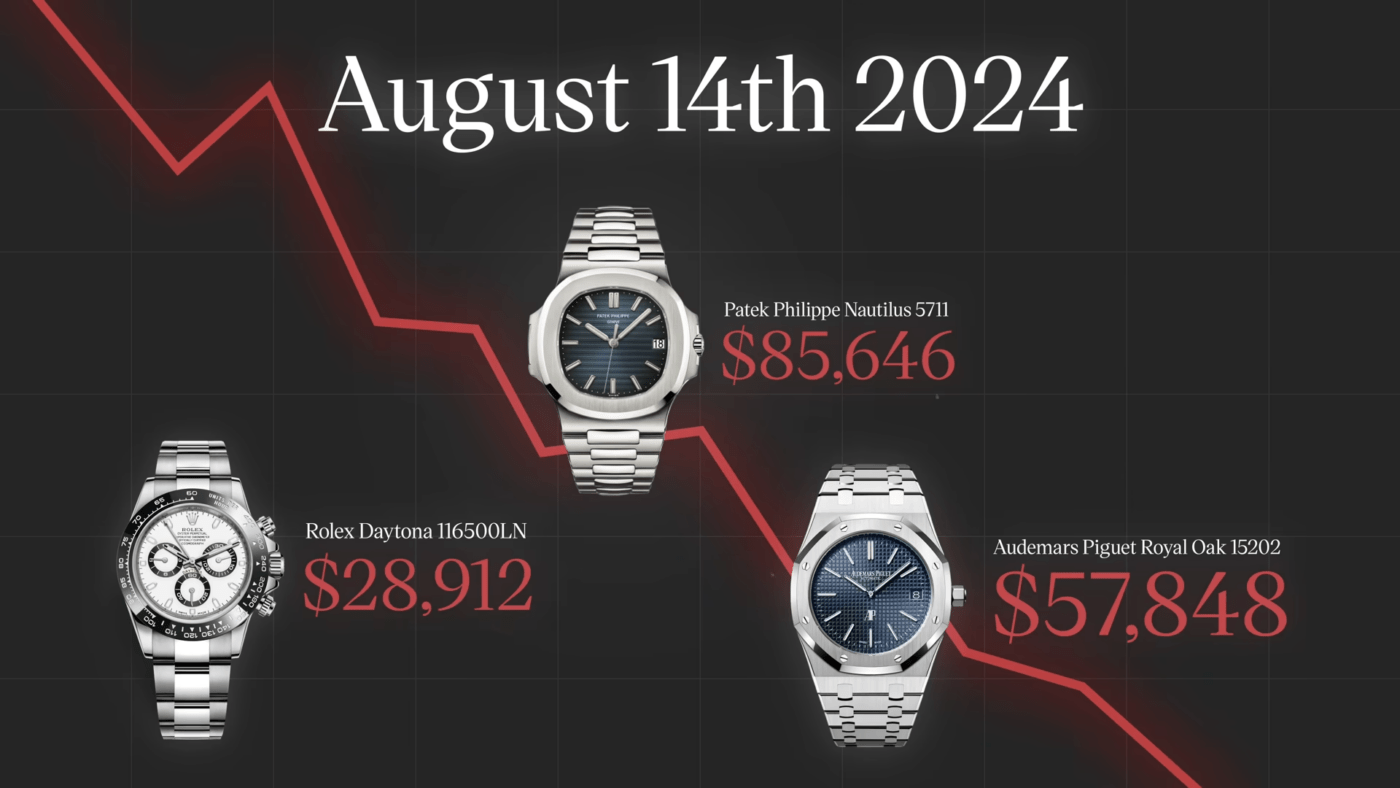

The last several years for watch trading values have been a roller coaster, to say the least. Certain hype watches saw unprecedented levels of appreciation in the secondary market, being multiples of their retail value. For example, in the spring of 2022, models such as the Rolex Daytona 116500LN traded at $49,183, the Patek Philippe Nautilus 5711 at $177,700, and the AP Royal Oak 15500ST at $118,407, yet two years later, these three pieces and many other plummeted in price. Let’s try to understand why the watch market prices rise and fall and what caused the downturn.

Introduction

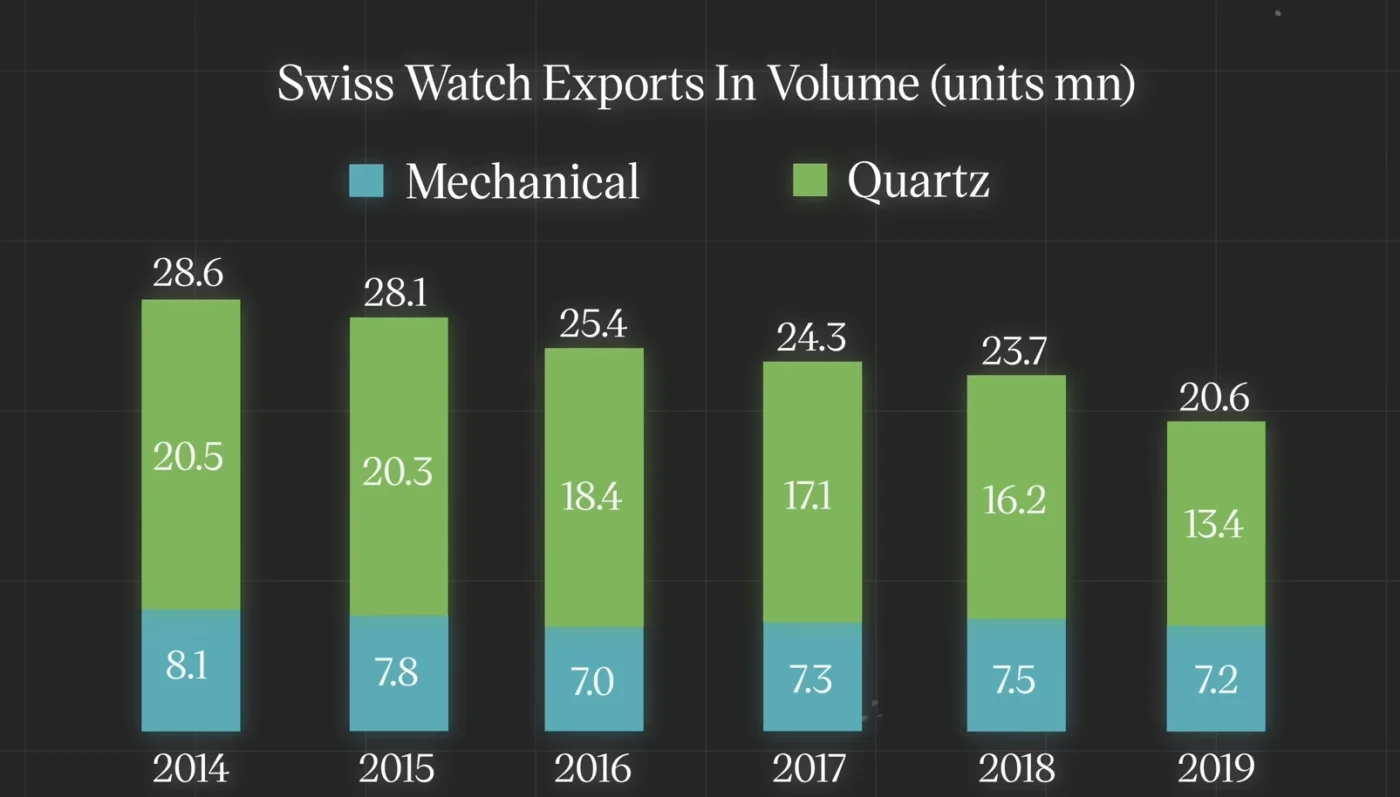

Since the rise and popularization of smartphones, you could argue that owning a mechanical watch, or any watch in general, is no longer a necessary tool for everyday life. Yet, despite this, mechanical and especially luxury watches have been relatively steady. If you look at the broader concept of Swiss exports, it does tell a bleak story for affordable quartz watch production, with total Swiss watch exports dropping from 28.6 million in 2014 down to 20.6 million in 2019, a drop of nearly 30%. But as you shift over to mechanical watches, you will notice that the market has not seen the collapse that you might expect in this period. You do see roughly an 11% drop in production, mostly as a byproduct of the more attainable end.

What became clear in recent years is that watches of the mechanical and high-end variety started to mean something different to buyers, where the concept of utility is there, yet it is no longer the main driving force for a purchase. A mechanical watch now is removed from the fast-moving world of disposable electronics that are chasing after the next technological improvement, where there’s a short life cycle of obsolescence. Given the moving target that comes with continuous innovation, this divergence from the originally found path as tools assisted watches to rather become collectible pieces of art, design, self-expression, and status that delivered a message that smartwatches could not fulfill.

The numbers also back this up, with brands like Rolex, AP, Vacheron, Patek, Richard Mille, FP Journe, and others seeing more demand than they ever had before. This redefining began the wave that would come with the fascination with collecting, where the hype quickly followed pieces, leading to hero products that could break through beyond the niche category of collectors to have widespread appeal.

The influence of Paul Newman

If we had to identify the tipping point for when the collector world collided with the broader public with just a moderate interest in watches, it would be back in 2017 when Paul Newman’s personal 6239 Daytona sold for $17.8 million at auction. This number was absolutely staggering and enough to grab the attention of the press and those outside of the watch-buying circles, giving rise to a different type of collector that was driven by chasing the exclusive, all while the old-school collectors remained captivated.

This fervor at the top had a trickle-down effect on new products, where select brands that were primarily private in their operation saw an influx of interest for their watches at retail, leading to the dawn of waitlists. That private point is an important one, as these brands could play the long game and did not face the same pressure to overproduce as a public company would, that would be aiming for the best returns possible for shareholders. Hence why brands like Rolex, AP, Patek Philippe, and Richard Mille saw tremendous demand growth during this period.

This rapid surge in inquiries for new watches released the perfect storm, as when watches became more difficult to buy, it set in motion even more fascination among a segment of luxury buyers, as the drive of validating whether a product was “worth it” was knowing that they had something others couldn’t have. Simultaneously, places like China saw a boom in the watch market, given the growing wealth in the nation and the swift boutique expansion by brands, with Rolex, for example, having over 160 points of sale in China alone.

Flipping culture

All of this gave rise to the flipping and dealing culture, where if you were lucky enough to get one of these watches at retail, your net worth basically jumped immediately as you walked out the door. Many people gave into the temptation of selling to dealers, and some not-so-great business practices started to take place as well, with certain secondary market dealers hoarding inventory of unknown products.

As it became increasingly harder to get pieces at retail, authorized dealers were no longer able to showcase watches in display cases, since as soon as new products would come in, it would be spoken for. From here came the game of navigating waitlists, and in some circumstances with less morally upright ADs, you saw the maximizing of profit by selling directly to secondary market dealers closer to trading market values instead of retail values.

And just as it seemed like it couldn’t get any more out of control, 2020 came around and the lockdowns kicked off a very complicated time for the watch industry. On one hand, it was disastrous in the early months as points of sale needed to be closed. In this industry, there are brands like Rolex that do not allow authorized retailers to sell online. Therefore, when lockdowns happened, it meant brands were essentially closed for business.

Production

Back at the factories overseas, you also had another issue that was brewing. As many of you probably already know, producing a watch that comprises hundreds of parts is not an easy manufacturing process to streamline, requiring a meticulous order of operation to ensure numbers and quality are met.

The accepted industry terms for assembly are as follows:

- T0: The pre-assembly of smaller components of a movement.

- T1: The assembly of the movement and final adjustments.

- T2: The adding of the hands and the casing of a watch.

- T3: The attachment of bracelets or straps and preparing the final presentation box.

We bring these points up because most watchmakers or technicians working for brands specialize in one key aspect of the assembly process rather than being able to do every step independently. Now, there are some smaller-scale productions and more bespoke pieces where one watchmaker will take it from start to finish, but as social distancing came into effect and people got sick, there was a massive issue in the production line where if one unit of the assembly was impacted and no longer worked, it held up the broader production on a brand-wide scale.

In addition, the shipment of raw materials and specialized parts like hairsprings, dials, and cases that sometimes might require shipment over country lines also were greatly disrupted. This combination of specialized workers who needed to work in close proximity with each other that could not be easily replaced while having difficulty in getting goods from suppliers was a recipe for slowed production.

Looking at the data for Swiss watch exports from 2019 to 2020, we saw one of the largest year-over-year drops in the history of the industry, where total exports sat at 20.6 million in 2019, falling to 13.8 million in 2020, a roughly 33% drop in production in one year. This might appear to have been the death blow for the industry at this time, but it somehow also had some dramatically positive effects as well.

Around this time, the health of the global market seemed to have a bleak future, so we saw one of the largest surges in government intervening to jump-start economic recovery by way of stimulus checks, drops in interest rates, and quantitative easing, which led to an influx of cash. Since lockdowns were still very much in effect, travel and leisure were no longer areas where people were looking to spend their money, so those with the means looked towards discretionary collectibles. This only exacerbated those waitlists that existed pre-COVID, as the newfound liquidity in the market created people ready to spend absurd amounts of money, even well over retail.

Market Liquidity

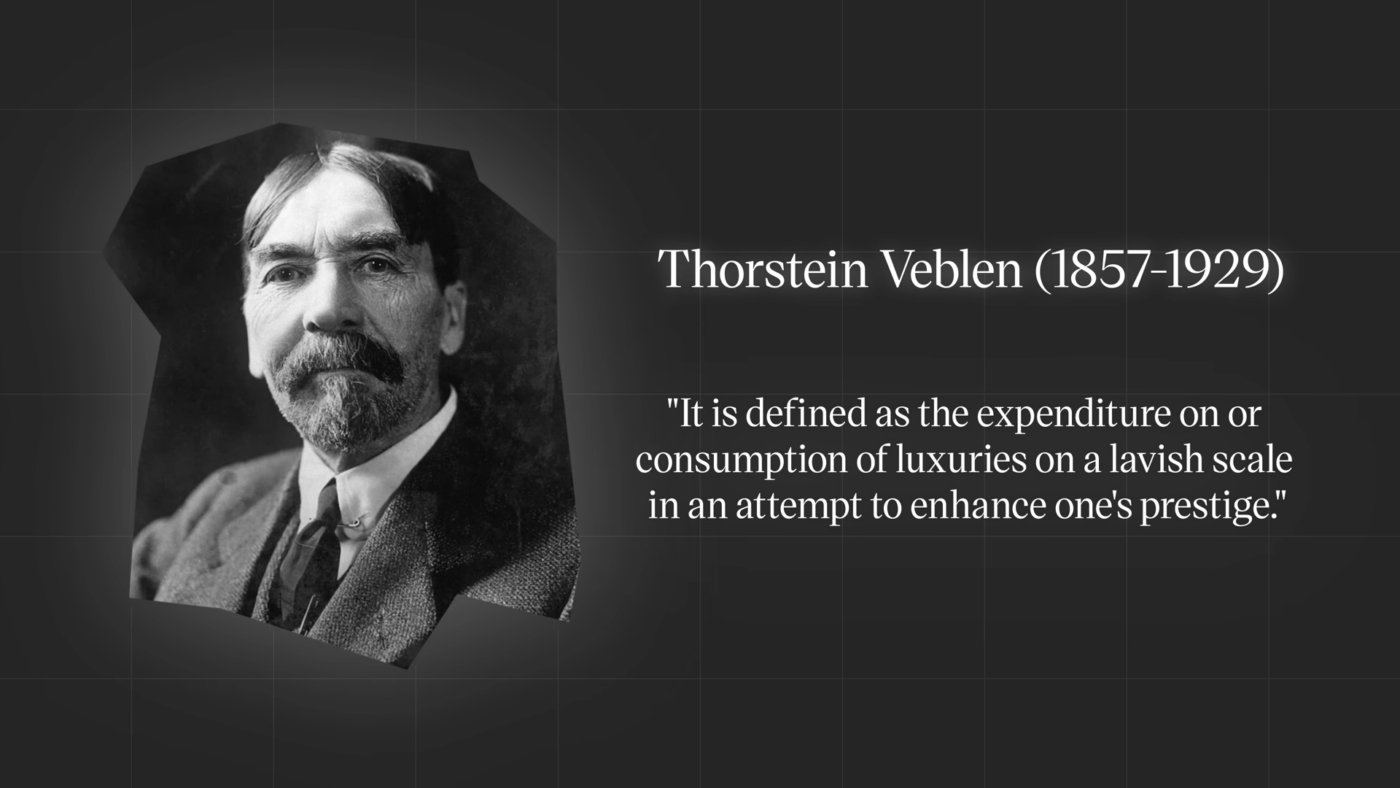

To provide a sense of what was taking place with the growing snowball of consumerism, a term coined by the 19th-century economist named Thorstein Veblen, it is defined as the expenditure on or consumption of luxuries on a lavish scale in an attempt to enhance one’s prestige. Following this research, it later unearthed that certain types of goods countered the simple rules of supply and demand.

In a typical scenario, goods that increase in price within the open market typically see a downturn in demand once prices reach a point beyond what buyers are willing to pay. However, in luxury goods, where consumer behavior is much different and need is not the same or even part of the equation altogether, there is a rare phenomenon that can take place where goods that see their prices go up can also see their demand rise, given that the difficulty to obtain is seen as a way to elevate status. This rare circumstance classifies these types of products as Veblen goods, and in this time of 2020 to 2022, watch collecting is one of the best examples of this concept in recent economics.

To add fuel to the fire were individuals on the outside who were looking at the increasing trading market values and saw this as an opportunity to increase their portfolio of wealth, thinking watches could become an investment vehicle. The attention at this point was mostly being directed towards the “big four.” However, the focus on these brands led to others beginning to succeed. An example of this is a brand like Vacheron Constantin with their Overseas models, specifically the blue dial Overseas that peaked in April of 2022 at a trading value of $49,917, a number that doubled their retail price at the time.

Yet, since people struggled to get allocation for the Nautilus and Royal Oak, buyers were looking elsewhere, with this same effect taking place in countless other scenarios of alternatives.

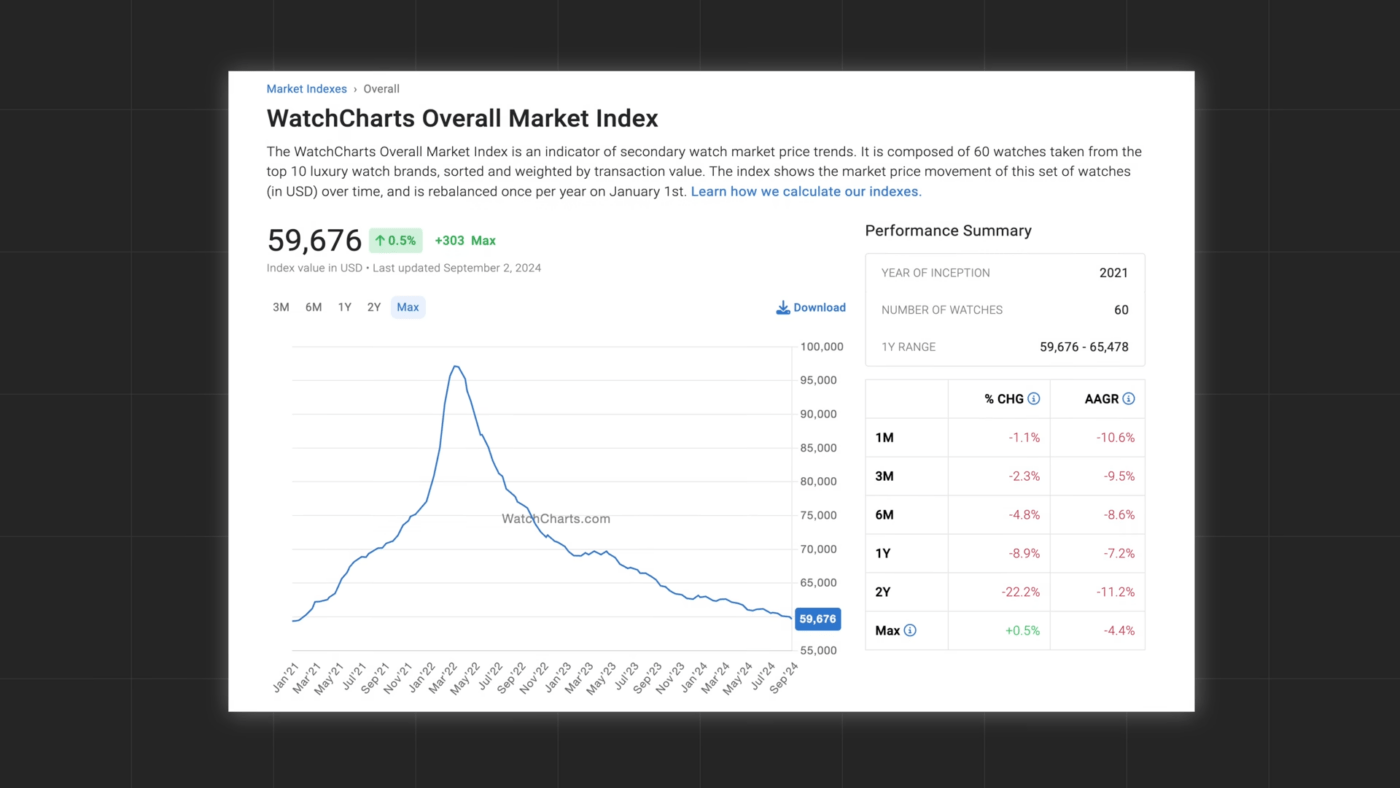

It was a completely unprecedented situation, and as the secondary market sustained, we had brands that were basically printing money, since as soon as they prepared a watch for sale they had a line of customers ready to buy for nearly every model. The secondary market peaked in the early spring of 2022 and positive momentum seemed never-ending, however as we know now, things were about to change.

According to the WatchCharts Watch Index, which takes the trading value of 60 watches taken from the top 10 luxury watch brands, sorted by transaction value, it shows that the secondary market has dropped over 36% since March 2022.

Sudden Drop

This brings us to the question of what exactly happened, as all of this seems unsustainable, and it was. The first signs of trouble started to appear in the public markets, with companies like Watches of Switzerland Group PLC, which owns numerous authorized dealerships and is publicly traded, seeing their stock price fall by over 60% from their all-time highs in the fall of 2021.

The writing was on the wall that the luxury watch bubble was about to burst, and in the spring of 2022, it did. The reasons for the decline are numerous, but some of the most significant include:

- Rising interest rates: The era of free money came to an end as inflation started to rear its ugly head. Central banks around the world were forced to raise interest rates to combat inflation, which made it more expensive to borrow money. This had a cooling effect on the luxury watch market, as people had less disposable income to spend on discretionary items.

- The war in Ukraine: The war in Ukraine created economic uncertainty and geopolitical instability, which led to a decline in consumer confidence. This also had a negative impact on the luxury watch market, as people were less likely to make large purchases during times of uncertainty.

- The cryptocurrency crash: The cryptocurrency market crashed in 2022, wiping out trillions of dollars in value. This had a significant impact on the luxury watch market, as many people had been using cryptocurrency to purchase watches.

- The Chinese lockdowns: The Chinese government imposed strict lockdowns in several major cities in 2022 in an attempt to control the spread of COVID-19. These lockdowns had a significant impact on the luxury watch market, as China is one of the largest markets for luxury watches.

These factors, combined with the fact that the market was simply overheated, led to a sharp decline in secondary market prices. Many people who had purchased watches at inflated prices were now left holding the bag, as they could no longer sell their watches for a profit.

It is important to note that the decline in secondary market prices does not mean that the luxury watch market is dead. The demand for luxury watches is still strong, but it is not as frenzied as it was in 2021 and early 2022. Prices are likely to stabilize at a more sustainable level, and the market will continue to be driven by genuine collectors and enthusiasts.

The collapse of the watch market bubble is a reminder that no market can go up forever. It is also a reminder that it is important to be cautious when making large purchases, especially during times of economic uncertainty.